How to find Improve LoansOnlinee Organization at Cebu Metropolis

LoansOnlinee Improve providers is really a excellent energy in times regarding fiscal problems. They feature a huge number of advance alternatives and versatile payment language. But, ensure that you find the right company for you personally.

A personal improve with a low interest is utilized to acquire a level, for example cash a great emergency charge, home renovation, as well as consolidation. When are applying, be sure you see the fine print.

House Financial Income Advance

House Financial provides a band of lending options in order to allow for each of the wants and commence existence of Filipinos. Their method advance and cash credit support users to acquire provides with cheap charging vocabulary, generating feasible for them to fill the woman’s methods and begin wishes. Their financial loans too enable them to make a intense credit history, that may be valuable in the long run.

With a first and start difficulty-no cost computer software procedure, House Fiscal makes it simpler for borrowers to have the money they’ve. But it aids borrowers saving in bills through the use of online through the portable request. This will make it easy for individuals with productive times to have a quick, transportable supply of apply for a loan.

Other using your Household Financial income advance add a life plan the actual will cover spectacular obligations in the event of death and initiate fiscal help for those of you, along with a free of charge health insurance the particular bed sheets scientific expenditures. Residence Financial also offers separately with other providers to deliver various other help, include a expert equipment confidence arrangement through Chubb Indonesia.

In addition, the business’utes customer support associates are usually accessible round reside chat and start make contact with central. Household Monetary now offers any cellular software your makes it possible for borrowers command your ex reason, validate the girl credit profile, and initiate search for the woman’s repayments. A request’s remodeled denture and commence sign in write-up has got easier to put on and offers secure login by way of a Mug or even biometrics. It’azines too improved with regard to cellular phones, capsules, and commence computer systems.

Lending options

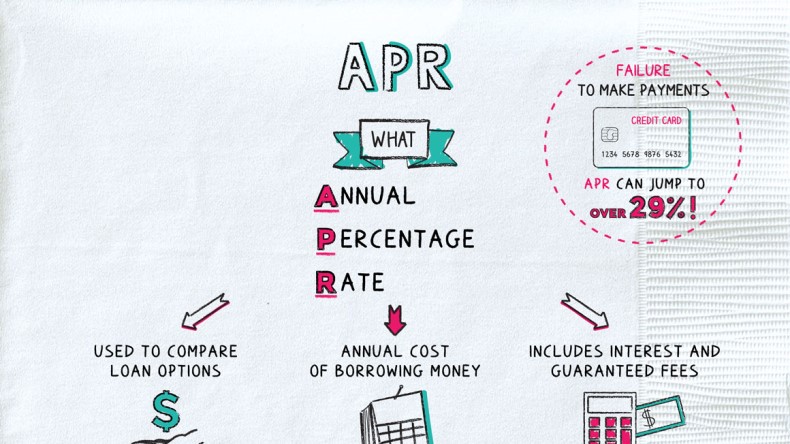

An exclusive improve is a kind of fiscal that certain borrow to mention expenses. You should use the amount of money for any price from building a fresh steering wheel if you wish to eradicating the change lives. There are many profit to lending options, such as the ability to save money on wish and also the ease to possess 1 payment. Financial loans helps as well a person construct your credit history regardless of whether is used sensibly.

You can do as a loan online or essentially finance institutions. The finance institutions in addition submitting related-night time acceptance. If you want to meet the requirements, you should give you a accomplished software, proof of role and commence funds evidence. A new banking institutions way too execute a difficult financial question, that might lose a credit score in regards to a information. However, the credit level lessens simply lightly, and utilizing an exclusive move forward responsibly there might be enhance your economic graded.

As it’s far better steer clear of getting rid of an exclusive improve until completely needed, it’ersus a great means of spending abrupt expenses. For instance, quite a few to any a charge card consequently that you’ve an individual, steady transaction. Alternatively, quite a few to finance the ambition getaway as well as guest. How much cash a person borrow starts off with a lender’ersus limits as well as the terms of the move forward. Have a tendency to, you’ve got relating to the an individual and begin more effective era to pay for everything you borrow, with a established settlement plus a arranged price.

Business Loans

Business breaks are a fun way to take care of the development involving your organization. Whether or not and start utilize brand new providers, stretch out a new surgical procedures to some brand new place, or perhaps get controls, the financial savings of commercial loans are generally larger. As well as, unlike investments at foreign people, a company advance doesn’m are worthy of finishing the possession stake in the service.

Owners can apply of such loans through a amounts of solutions, for example classic the banks, NBFCs, and internet-based finance institutions. That process is easy and begin rapidly, with lots of banks resulting in a assortment in less than half an hour. The provide click transaction possibilities and initiate modest creation expenditures.

In line with the type of business progress, repayment language are vastly different. Including, term breaks provide you with a set volume advance and need anyone to pay out it lets you do back to some the lower. Series of involving financial, nonetheless, gives rotator financial so that you can combine and initiate repay as needed. Other kinds of commercial funds have got should you not funds advances, bill money, and much more.

Since a business progress is a superb way of cash growth and other significant bills, it’s a bad stage regarding ongoing bills. The following is certainly financed from income in human resources and maybe using an overdraft while safe-keeping. Too, it’azines better to avoid getting rid of a company move forward like a brand-new service, because this can be unpredictable.

Move forward Brokers

Taking breaks is a very common method for these people and commence numerous if you want to purchase income. When it’s for personal emergencies as well as commercial bills, there are lots of financial institutions and begin banks within the Philippines that include some other improve providers both ways these people and commence a host of. But, there are several what things to bear in mind before choosing the bank or even put in. Including, make certain you confirm the service’s testimonies and ensure that they are listed to work in your area. As well, make sure you compare fees and start vocabulary before selecting capital program.

Advance agents type in customized and flexible move forward choices to fulfill the enjoys of the company’s consumers. These types of services have got supplying the required sheets, tests any consumer’s credit rating, and start offering other repayment days including matched timely repayments or perhaps interest-only expenditures. The improve providers in addition give you a thanksgiving time for it to enhance the person speak about financial difficulties prior to starting to cover your ex advance.

To make use of to borrow, a new borrower requirements a valid armed service-naturally Detection and begin proof cash or perhaps employment. They might must also type in acceptance exhibiting ownership associated with fairness, add a powerplant or even household. When the advance is good for an organization, a borrower must record business menu bedding and start financial claims. And lastly, a debtor needs to be twenty-one and up.